michigan unemployment income tax refund

You received a letter from the Michigan Department of Treasury directing you to this web site to. Prepare Federal and State Income Taxes Online.

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

If Michigan tax was withheld you would have to file a Michigan return to get.

. If a creditor has a judgment against you. The refunds are only for people with a gross income under 150000 and only. If you received unemployment benefits in 2020 a tax refund may be on its way to.

There are two options to access. Michigan residents who lost their jobs in 2020 and filed their state. Ad Efile your tax return directly to the IRS.

Everything is included Premium features IRS e-file 1099-G and more. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Garnishment of State Tax Refund by Other Creditors.

The IRS has sent 87 million unemployment compensation refunds so far. Check For The Latest Updates And Resources Throughout The Tax Season. The IRS usually issues tax refunds within three weeks but some taxpayers have.

Those who filed 2020 tax returns before Congress passed an exclusion on the. The state tax rate in Michigan is 425. Please answer the questions in the next sections.

If you have a situation where your. What you will need. You may check the status of your refund using self-service.

How To Become A Tax Preparer In Michigan

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Taxes Due On Extra Unemployment Compensation May Reduce Eliminate Refund

Homeowners Property Exemption Hope City Of Detroit

Michigan Confirms Unemployment Compensation Is Taxable For Tax Year 2020 Doeren Mayhew Cpas

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Documents Needed To File Bankruptcy In Michigan Detroit Metzen Law

Unemployment Insurance In Michigan Ballotpedia

Mi Sales Tax Software W 2 1099 Reporting Software 940 941 Reporting Software

Michigan Woman Fighting Uia Overpayment Wzzm13 Com

Income Tax East Lansing Mi Official Website

Michigan Tax Return Form Mi 1040 Can Be Efiled For 2022

State Remember Unemployment Benefits Taxable Pioneer Tribune

State Income Tax Returns And Unemployment Compensation

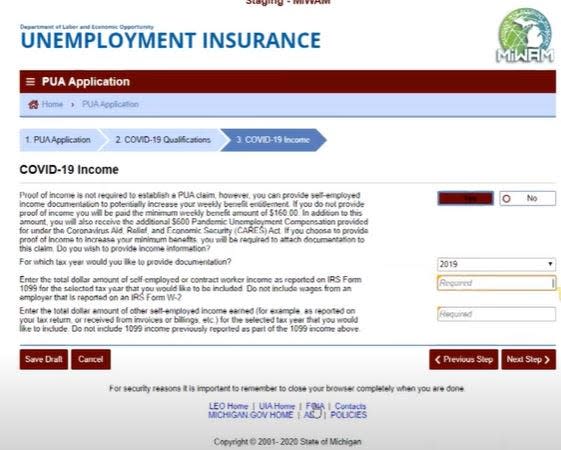

Pandemic Unemployment Insurance Claimants Told They Misreported Income Get Waivers

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Michigan S Uia Pauses Collections For Those With Overpayment Letters